Introduction

Understanding the size of a market is an essential step for any company or startup that wants to launch a product, attract investors, or expand its operations. Without this clarity, strategic decisions end up being based on subjective perceptions, increasing the risk of mistakes.

In this article, we’ll explore the two main ways to size a market — top-down and bottom-up — introduce the acronyms TAM, SAM, and SOM, and present practical tools that can support the process.

Approaches to Market Sizing

1. Top-Down (From the Top Down)

The top-down method starts with a macro view: the total size of the global or regional market, followed by an estimate of the share your company could capture.

Practical example: If the global health app market moves US$100 billion, a startup may project capturing 0.1% of that value within five years.

Advantages: fast, accessible, and useful for investor presentations.

Limitations: tends to be optimistic and may overlook local particularities or operational constraints.

2. Bottom-Up (From the Bottom Up)

This approach starts from the most realistic basis: consumer behavior, competitors’ sales volume, and available data from similar products.

Practical example: if a similar product sold 50,000 units last year, you can estimate how much of that audience might migrate to or adopt your solution.

Advantages: provides a more conservative and realistic analysis, essential for solid financial projections.

Limitations: requires more time, detailed data collection, and deeper analysis.

Rule of thumb: for investors, present both analyses. Top-down shows the total opportunity, while bottom-up demonstrates practical feasibility.

The Essential Acronyms: TAM, SAM, and SOM

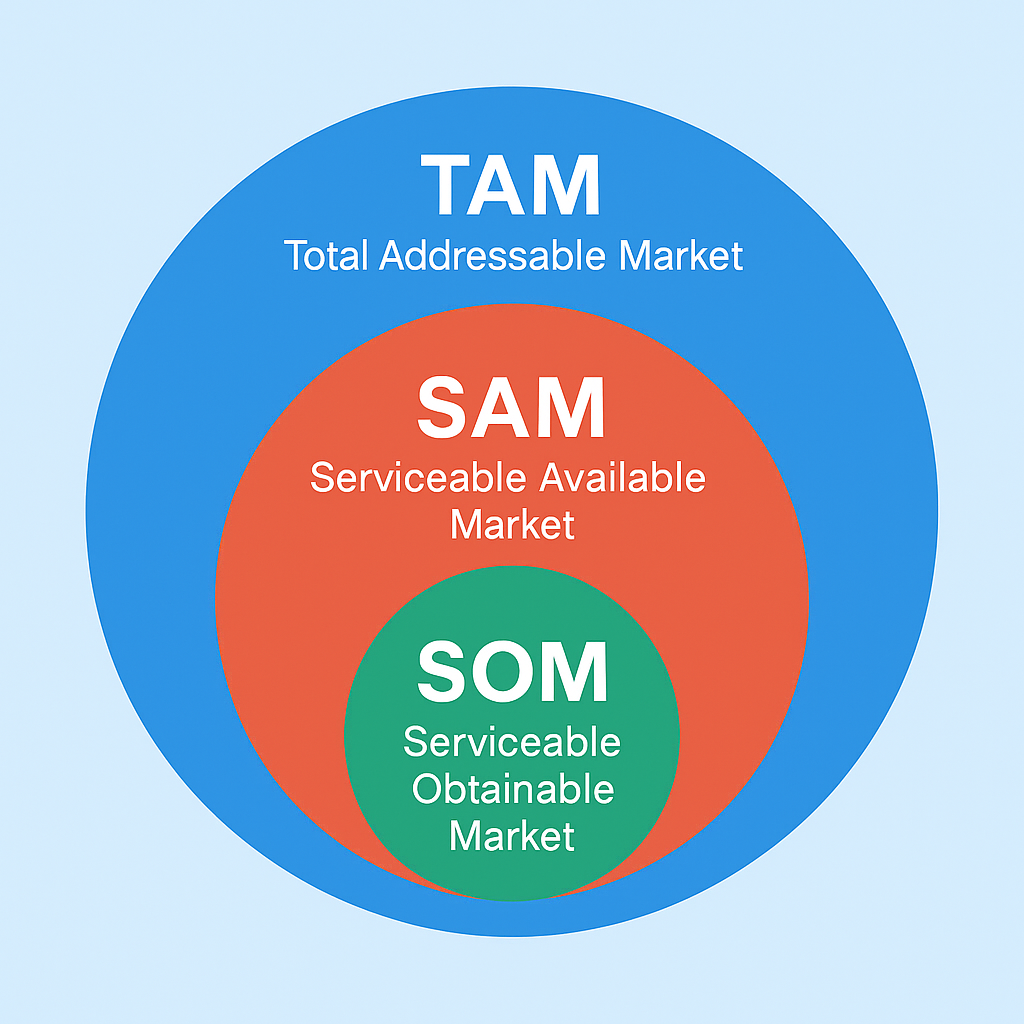

In market sizing, three established acronyms help differentiate total, accessible, and realistic opportunities:

- TAM (Total Addressable Market) – the total market value if every potential customer used your product. It aligns with the top-down reasoning.

Example: The global health app market is estimated at US$100 billion. - SAM (Serviceable Available Market) – the portion of the TAM that your company can serve, considering region, segment, or regulatory restrictions. It’s the “realistic slice” of the opportunity.

Example: If the startup operates only in Latin America, and that market is worth US$10 billion — that’s the SAM. - SOM (Serviceable Obtainable Market) – the part of the SAM you can realistically capture, given your operational capacity, marketing investment, and competition. It aligns with the bottom-up reasoning.

Example: Within the US$10 billion Latin American market, the company projects reaching 1% in five years, or US$100 million.

In summary:

| Concept | Meaning | Example |

|---|---|---|

| TAM | The whole cake | US$100B |

| SAM | The slice you can serve | US$10B |

| SOM | The piece you can eat | US$100M |

Tools and Techniques for Data Collection

- Industry Reports: Searching Google for “industry reports for [sector]” is an efficient way to access data from renowned consultancies (PwC, Deloitte, Gartner, McKinsey, IBGE, etc.).

- Competitor Traffic Analysis: Platforms like SimilarWeb or Semrush help you understand the reach and engagement of established companies.

- Google Ads Keyword Planner: A free tool that shows search volumes, related terms, and consumer interest trends.

- Social Media and Forums: Useful for gauging emerging needs, feedback, and audience sentiment.

Conclusion

Market sizing is more than a numerical exercise — it’s a strategic process that balances opportunity vision with operational realism.

- The top-down approach helps reveal potential.

- The bottom-up approach ensures consistency and feasibility.

- The use of TAM, SAM, and SOM structures your reasoning and brings clarity to communication with investors and managers.

Ultimately, the goal isn’t just to know “how much the market is worth,” but to understand which share you can realistically capture — efficiently and sustainably.

You may also like: Finding and Analyzing Competitors: A Practical Guide for Product Managers

Reach a global audience of portfolio, program, and project managers, product leaders, and certification professionals. Explore advertising opportunities .

Sponsored