In many organizations, investment decisions still orbit around a single gravitational force: ROI. If the return looks attractive enough on a spreadsheet, the project is approved. If the projected percentage drops below a predefined threshold, it is rejected.

At first glance, this seems rational. ROI is simple, familiar, and financially grounded. But in complex transformation environments—where multiple programs interact, benefits emerge over time, and change impacts ripple across stakeholders—ROI alone is dangerously incomplete.

Strategic portfolio management requires a more mature lens. It requires moving from isolated financial returns toward real net portfolio value—a calculation that integrates probability of benefit realization, cost of change, quality of governance, stakeholder impact, and strategic alignment.

If ROI measures financial optimism, portfolio net value measures strategic realism.

The Problem with ROI in Complex Change Environments

ROI assumes three conditions that rarely exist in transformation portfolios:

- Benefits are predictable.

- Costs are fully understood.

- Execution quality does not materially affect value realization.

In practice, none of these assumptions hold.

Benefits are probabilistic. Costs evolve. Execution capability varies dramatically across programs. Cultural resistance can erode expected gains. Integration complexity can amplify effort. And benefits may only partially materialize if change adoption fails.

Traditional ROI ignores the quality of benefit realization management (BRM). It assumes that if value is theoretically possible, it will be delivered.

Portfolio leaders know better.

From ROI to Net Portfolio Value

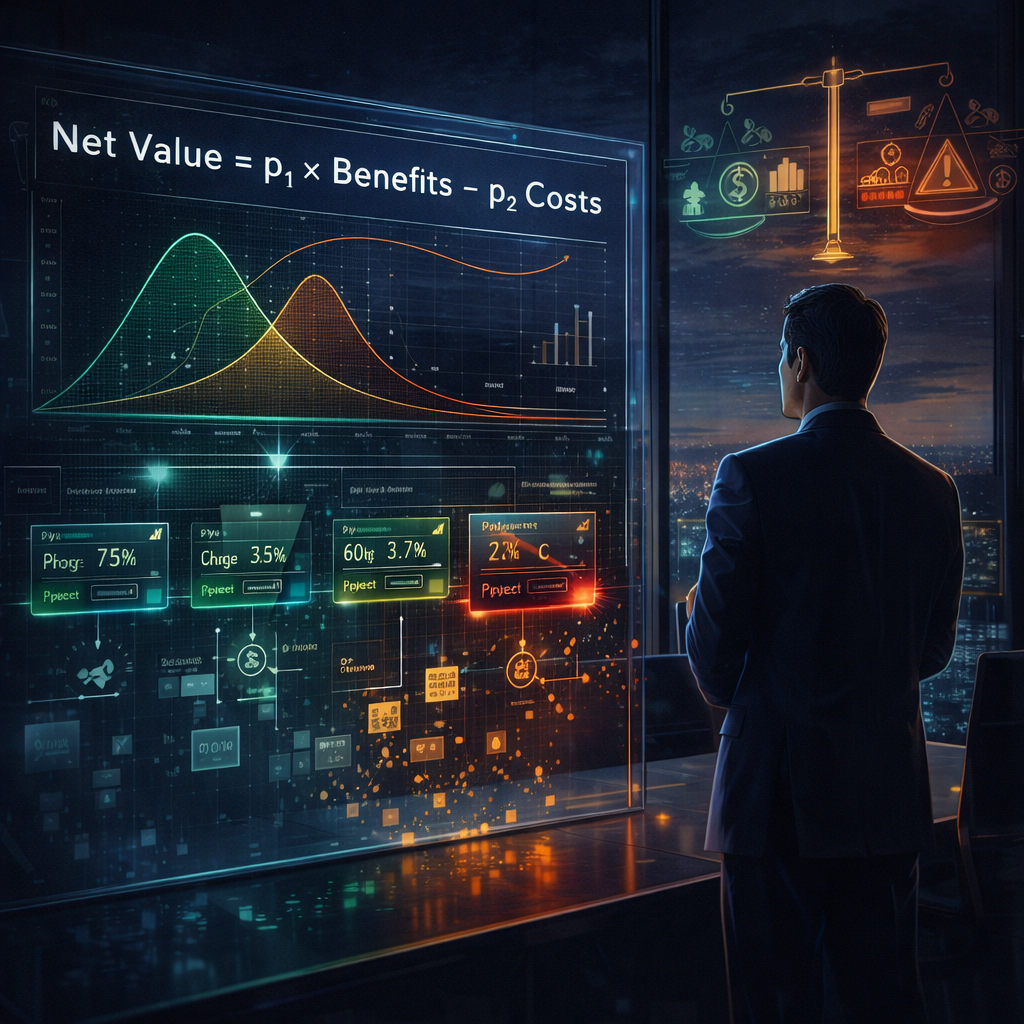

To calculate real portfolio value, organizations must incorporate uncertainty and execution quality into their models. One of the most powerful conceptual shifts is moving toward a probabilistic net value equation:

Net Value = p₁ × Potential Benefits − p₂ × Estimated Costs

Where:

- p₁ represents the proportion of potential benefits likely to be realized.

- p₂ reflects the proportion of total costs likely to materialize—including hidden change costs.

This approach forces two critical governance conversations:

- How confident are we that benefits will actually be delivered?

- How confident are we that we have fully captured the cost of change?

In immature environments, p₁ is often far below 1. In fact, many transformation initiatives realize only a fraction of projected benefits. Meanwhile, p₂ may exceed 1 when business disruption, adoption delays, and integration rework are excluded from initial business cases.

The result is a net value illusion.

The Missing Variable: Quality of BRM

The probability of benefit realization is not random. It is influenced by how well BRM is applied.

When benefit ownership is unclear, measures are weak, or tracking is inconsistent, p₁ decreases. When stakeholder engagement is late, resistance increases. When performance reporting is superficial, underperformance remains hidden.

Conversely, strong BRM disciplines increase the likelihood of benefit realization by:

- Defining measurable outcomes early.

- Assigning accountable benefit owners.

- Monitoring benefit realization plans continuously.

- Linking change activities directly to expected outcomes.

- Escalating underperformance promptly.

This is why assessing the quality of BRM application must be embedded into portfolio evaluation—not treated as a compliance exercise.

High potential value with weak BRM discipline is a strategic risk.

Portfolio-Level Trade-Offs

Calculating net value at the individual project level is only the first step. True portfolio optimization requires comparing initiatives along two dimensions:

- Value to the business.

- Complexity of required change.

Projects with high value and manageable complexity are strong candidates. Projects with low value and high complexity may require termination. But the real challenge lies in the middle zones—where benefits are moderate and change effort is substantial.

In these cases, the quality of BRM can determine whether an initiative should be intensified, redesigned, or stopped.

Portfolio governance becomes less about approving projects and more about actively managing value probability.

The Hidden Costs of Change

ROI calculations often exclude:

- Stakeholder training effort.

- Productivity dips during transition.

- Cultural resistance mitigation.

- Process redesign impact.

- Technology integration complexity.

- Opportunity cost of diverted resources.

These are not marginal costs—they are central to value realization.

When these elements are excluded, p₂ (true cost proportion) increases silently after approval. Budget overruns become “unexpected.” Benefit erosion becomes “market volatility.” In reality, it is estimation immaturity.

Mature portfolio management explicitly evaluates change readiness and adoption capacity before approving investment.

Portfolio Governance and Net Value Discipline

The Portfolio Board plays a decisive role in embedding net value thinking. Its responsibilities extend beyond project approval into continuous value monitoring.

Strategic maturity requires that boards:

- Reassess benefit assumptions periodically.

- Monitor realization probability, not only milestone progress.

- Investigate projects missing benefit targets.

- Identify candidates for removal from the portfolio.

- Reallocate resources dynamically toward higher-value initiatives.

This shifts governance from passive oversight to active value stewardship.

The hardest conversation in portfolio governance is not “Should we start this project?” It is “Should we continue funding this project?”

Net value models provide the analytical backbone for that decision.

Portfolio Assessment Matrices as Value Tools

Sophisticated organizations use structured matrices to support these decisions, such as:

- Value versus complexity matrices.

- Required versus observed BRM application assessments.

- Strategic alignment scoring models.

- Resource intensity versus benefit probability grids.

These tools allow portfolio leaders to identify:

- High-value initiatives with insufficient BRM effort (requiring intervention).

- Low-value initiatives with high execution cost (requiring termination).

- Medium-value initiatives that could be upgraded through governance improvement.

The key insight is this: portfolio management is not about maximizing the number of projects. It is about maximizing net value per unit of constrained resource.

Sunk Cost Bias and the Illusion of Commitment

One of the greatest threats to net value optimization is sunk cost bias.

Once money, time, and political capital have been invested, decision-makers hesitate to stop initiatives—even when revised net value calculations turn negative.

Strategic maturity means recognizing that past investment is irrelevant to future value potential.

A project with negative forward net value destroys portfolio performance regardless of historical spend.

The most mature portfolios are not the ones that never terminate projects—they are the ones that terminate them decisively and redirect capital efficiently.

Moving from Approval Culture to Value Culture

Many organizations operate in an approval culture: once a project is sanctioned, it becomes politically protected.

Net value discipline requires a value culture instead—where initiatives must continuously justify their strategic contribution.

In such environments:

- Business cases are living documents.

- Benefit realization plans are reviewed regularly.

- Performance dashboards reflect outcome metrics, not activity metrics.

- Leadership rewards value creation, not project survival.

This cultural shift often requires embedding BRM expertise within the PMO and establishing consistent methodologies across programs.

Net Value as a Portfolio Optimization Engine

When properly implemented, net value modeling enables:

- More rigorous prioritization.

- Better balance between innovation and operational stability.

- Improved capital allocation.

- Stronger alignment with corporate strategy.

- Reduced waste of organizational capacity.

It also creates transparency. Stakeholders can understand why some initiatives are accelerated while others are paused or terminated.

In volatile markets, this adaptability becomes a competitive advantage.

The Strategic Imperative

Calculating real portfolio net value is not a financial exercise. It is a governance discipline.

It forces leaders to confront uncertainty.

It exposes execution weaknesses.

It reveals hidden costs.

It encourages strategic courage.

ROI tells you what might happen in theory.

Net portfolio value tells you what is likely to happen in reality.

Organizations that master this distinction do not simply run projects—they manage change as a strategic investment portfolio.

And in doing so, they stop asking, “What is the return?”

They start asking, “What is the real probability-adjusted value of this transformation—and is it worth our finite capacity?”

That is the question mature portfolio governance must answer.

Reach a global audience of portfolio, program, and project managers, product leaders, and certification professionals. Explore advertising opportunities .

Sponsored